Ramesys Global

Admin

- Feb 8, 2021

- 6 min read

The Budget Puzzle - What's the Missing Piece?

According to PwC, 78% of survey respondents report that budgets do not align well with strategy and according to a Deloitte’s survey, ‘budget alignment’ is the number one business planning challenge globally.

General Electric’s Jack Welch believes conventional budgeting is an exercise in corporate gaming “because everyone is negotiating for the lowest target”.

General Electric’s Jack Welch believes conventional budgeting is an exercise in corporate gaming “because everyone is negotiating for the lowest target”.

In Napoleon folklore, I wonder how the famous emperor’s troops would have fared if they were lacking in coordination?

Alignment ensures that all the horses work together to ‘propel the chariot forward at maximum velocity’ and you would be hard pressed to plan for peak performance without aligning the parts. Yet, as the above-mentioned surveys suggest, the majority of businesses are struggling to hit this mark.

The Benefits of Alignment

Alignment redirects focus towards ‘the plan’. While the finance team is responsible for managing the budget process, operational managers should accept responsibility for their area’s budgets by developing the tactics required to achieve common goals.

“Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.” — Sun Tzu

In pragmatic terms, this is achieved by clarifying roles and responsibilities and directing attention to the ‘How?’ i.e. what is the thinking to support the budget numbers?

Tactical planning is integral to the budget as it links the activities on the ground to the overall objectives. The benefit of this is that the budget becomes more of an enabler and less of a beating stick.

When every person is crystal clear on their role and effort is coordinated, two important things happen.

-

People become energised

-

Goals are stretched

When people become energised, the budget plan becomes less ‘cat and mouse’ and more about performance. Staff understand the big picture and how their performance contributes to the success of the business. They are engaged now with a greater probability of exceeding their goals.

6 Practical Ways to Align Budgets with Strategy

Strategy is often developed at the executive level while the resulting insights and dialogue are not appropriately spread through the rest of the organization. Without the required level of knowledge, the stakeholders who create and manage budgets do not know how they can best impact it and where to most effectively allocate their resources and spending.

Strategy is often developed at the executive level while the resulting insights and dialogue are not appropriately spread through the rest of the organization. Without the required level of knowledge, the stakeholders who create and manage budgets do not know how they can best impact it and where to most effectively allocate their resources and spending.

In order to better align budgets with strategy, here are some steps that Ramesys recommends:

1. Engage Staff by Sharing the Vision and Strategic Agenda

At the start of every budget cycle the Executive needs to share their insight into the company strategy. This brings about clarity on the way forward and by inviting feedback and questions, every employee will feel that they have a direct impact on the success of the business. Ideally, every employee should develop an understanding of how their role and actions will help the company achieve its goals.

2. Extend the Budget to the Medium to Long Term

Budgets are typically built for a year, however business initiatives are often rolled out over a number of years. Accordingly, a 12 month budget does not always provide a complete picture. Discussion around the budget for the next year should take place with reference to the three (3) to (5) year strategic plan. Inclusion of the long term plan figures will ensure that the tactical elements of the budget align with the long term goals of the organization.

3. Identify Key Business Drivers and KPIs

Identifying the key business drivers is important in that that it helps drive performance. A budget should be set for these key performance indicators (KPIs) and include both financial and non-financial indicators, distinguishing between early indicators of success or failure and lagging indicators. These metrics should be well defined, clearly measurable and understood.

Identifying the key business drivers is important in that that it helps drive performance. A budget should be set for these key performance indicators (KPIs) and include both financial and non-financial indicators, distinguishing between early indicators of success or failure and lagging indicators. These metrics should be well defined, clearly measurable and understood.

By frequently communicating these metrics and inviting feedback from staff, the business should develop a sense of awareness of what success should look like.

4. Set Realistic Assumptions as Part of the Budget Settings

Managing uncertainty is a big part of the planning process and it is usual for key assumptions to be made when starting the budget cycle. Both these assumptions and the overall goals set should realistic. If the current economy is flat, growth projections should be adjusted accordingly. The thinking and corresponding plan on how the numbers will be achieved should be clearly articulated and documented.

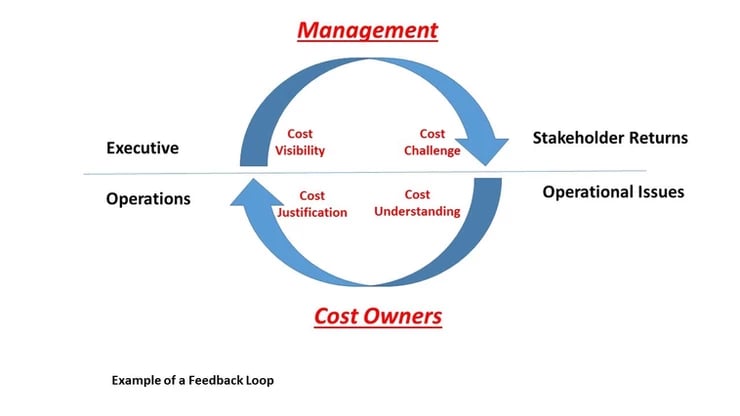

5. Feedback Loops and Strategy Revision

Many organisations spend hours developing strategy and then let their plans gather dust. The key lies in the execution. This means bringing the plans to life by engaging staff and keeping the plans relevant. Market conditions are forever changing and an agile approach to planning is required in order to survive in the modern economy. The business should have a process for reviewing plans and adjusting on a periodic basis. By periodically reviewing and updating plans, companies ensure they stay on course.

6. Identify and challenge the gap

In developing their strategic plans, teams often identify gaps in where they are versus where they need to be. Many times, there is a disconnect between what is expected and what is possible. This gap needs to be challenged and sanity checks put in place by asking “How?” and “Why?” The strategic initiatives required to overcome these gaps should be mutually agreed upon. A good budgeting process and planning tool will provide a management challenge and cost owner justification process and can aid with collaboration, visibility and process efficiency.

Case Study

Olympic Dam’s tight implementation deadline was easily met and within the agreed budget.

Olympic Dam’s tight implementation deadline was easily met and within the agreed budget.

Their realistic operational budget has been achievable due to the engagement of all the cost centre managers in development and ownership of the budget. Month end reporting is now generated at the push of a button, saving many days of accountants time.

For more information visit the page: Delivery of Cost Improvement Software & Coaching...

Or contact one of our friendly consultants...

0 comments